Matcha Industry Report - August 2025

Matcha Industry Report is Ooika's monthly coverage of the Japanese tea industry, specifically Matcha. Join our newsletter here to keep up to date.

Big Updates: Announcement of the 1st harvest tea picking area, fresh leaf harvest volume, and crude tea production volume in 2025

2025 Harvest Statistics

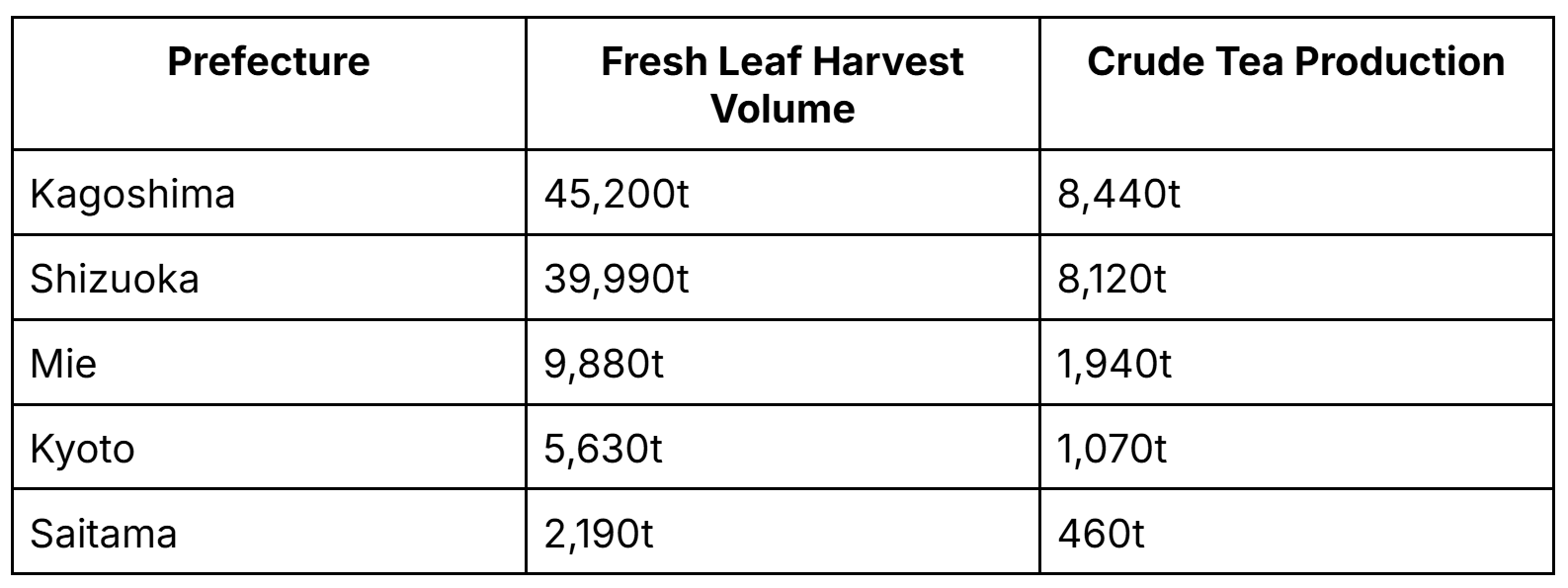

On August 19, the Ministry of Agriculture, Forestry and Fisheries announced the picking area, fresh leaf harvest volume, and crude tea production volume (major producing prefectures) for the first flush of tea for the 2025 harvest.

Shizuoka’s Production Decline

In 2025, Shizuoka Prefecture recorded a 1st harvest (一番茶ichibancha) production volume of 8,120 tons, representing a 19% year-on-year decline. Kagoshima Prefecture, on the other hand, produced 8,440 tons, maintaining nearly the same level as the previous year.

Consequently, for the first time since statistical surveys began in 1991: Kagoshima surpassed Shizuoka in ichibancha production.

Shizuoka, which had held the leading position nationwide for more than three decades, fell to second place.

It should also be noted that in the previous year, Shizuoka lost its top position in total annual Aracha 荒茶 (crude tea) output— a ranking it had maintained for over 60 years— to Kagoshima.

With this latest shift, even in the ichibancha segment, which Shizuoka had strategically prioritized, the prefecture has ceded the leading position.

According to the Ministry of Agriculture, Forestry and Fisheries, the decline in Shizuoka’s production was driven by multiple factors including:

A reduction in the number of producers

Aging of the farming population

Crop conversion to alternative commodities

And unfavorable climatic conditions.

A Comment on the Changes

From early April to early May 2025, an increased frequency of low minimum temperatures suppressed the growth of new shoots, resulting in lower yields.

In contrast, Kagoshima benefitted from higher productivity per unit area and favorable weather conditions. Ample sunshine combined with appropriately timed rainfall after April facilitated smooth crop development and stable yields.

A representative of the Shizuoka Prefectural Tea Promotion Division commented:

“As Japan’s traditional tea-producing region, Shizuoka is committed to regaining its position as the nation’s leading producer by reinforcing the production base, including the expansion of high-yield cultivars.”

According to statistics from the Ministry of Agriculture, Forestry and Fisheries, the 1st harvest tea (crude tea) production figures for major prefectures excluding Shizuoka and Kagoshima are as follows:

・Mie Prefecture: 1,940 t (down approximately 8% from the previous year)

・Kyoto Prefecture: 1,070 t (down approximately 19% from the previous year)

・Saitama Prefecture: 460 t (up approximately 2% from the previous year)

As a result, Mie and Kyoto are showing a decline in production, while Saitama is the only prefecture to see an increase, which is unusual.

Tea Industry Bankruptcies and Closures (Jan–Jul 2025)

According to a survey conducted by Teikoku Databank on trends in bankruptcies, business closures, and dissolutions among tea manufacturers, the total number of cases between January and July 2025 reached 11 (10 closures and 1 bankruptcy involving liabilities of over 10 million yen under legal liquidation).

・Trend: Already exceeds the 2024 total of 10 cases; projected to reach a record high

・Key driver: Domestic and international “matcha boom,” including inbound tourism, has unexpectedly impacted small and medium-sized tea manufacturers

The market is experiencing accelerating polarization, with well-capitalized or vertically integrated producers benefiting, while smaller operators face increasing financial pressure

AI Statement No AI was used in the creation of this content. All Ooika articles, content, emails and more are written and reviewed by real people.

What do Japanese Tencha (unground Matcha) famers do during the winter months?